When oil started gushing into the Gulf of Mexico in late April 2010, friends asked George Haller whether he was tracking its movement. That’s because the McGill engineering professor has been working for years on ways to better understand patterns in the seemingly chaotic motion of oceans and air. Meanwhile, colleagues of Josefina Olascoaga in Miami were asking the geophysicist a similar question. Fortunately, she was.

For those involved in managing the fallout from environmental disasters like the Deepwater Horizon oil spill, it is essential to have tools that predict how the oil will move, so that they make the best possible use of resources to control the spill. Thanks to work done by Haller and Olascoaga, such tools now appear to be within reach. Olascoaga’s computational techniques and Haller’s theory for predicting the movement of oil in water are equally applicable to the spread of ash in the air, following a volcanic explosion.

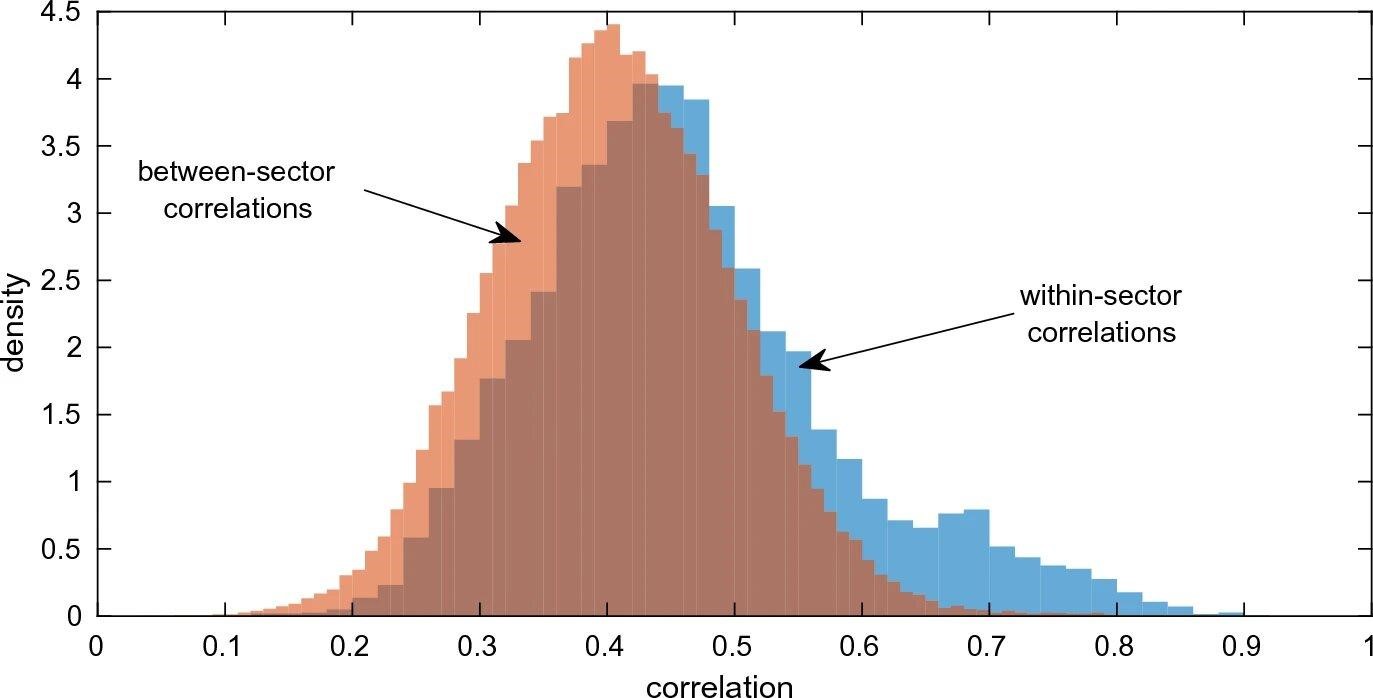

“In complex systems such as oceans and the atmosphere, there are a lot of features that we can’t understand offhand,” Haller explains. “People used to attribute these to randomness or chaos. But it turns out, when you look at data sets, you can find hidden patterns in the way that the air and water move.” Over the past decade, the team has developed mathematical methods to describe these hidden structures that are now broadly called Lagrangian Coherent Structures (LCSs), after the French mathematician Joseph-Louis Lagrange.

“Everyone knows about the Gulf Stream, and about the winds that blow from the West to the East in Canada,” says Haller, “but within these larger movements of air or water, there are intriguing local patterns that guide individual particle motion.” Olascoaga adds, “Though invisible, if you can imagine standing in a lake or ocean with one foot in warm water and the other in the colder water right beside it, then you have experienced an LCS running somewhere between your feet.”

“Ocean flow is like a busy city with a network of roads,” Haller says, “except that roads in the ocean are invisible, in motion, and transient.” The method Haller and Olascoaga have developed allows them to detect the cores of LCSs. In the complex network of ocean flows, these are the equivalent of “traffic intersections” and they are crucial to understanding how the oil in a spill will move. These intersections unite incoming flow from opposite directions and eject the resulting mass of water. When such an LCS core emerges and builds momentum inside the spill, we know that oil is bound to seep out within the next four to six days. This means that the researchers are now able to forecast dramatic changes in pollution patterns that have previously been considered unpredictable.

So, although Haller wasn’t tracking the spread of oil during the Deepwater Horizon disaster, he and Olascoaga were able to join forces to develop a method that does not simply track: it actually forecasts major changes in the way that oil spills will move. The two researchers are confident that this new mathematical method will help those engaged in trying to control pollution make well-informed decisions about what to do.

For more such insights, log into our website https://international-maths-challenge.com

Credit of the article given to University of Miami